Does Trinity Biotech (NASDAQ:TRIB) Have A Healthy Balance Sheet?

Warren Buffett famously said, ‘Volatility is far from synonymous with risk.’ It’s only natural to consider a company’s balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Trinity Biotech plc (NASDAQ:TRIB) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can’t fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company’s use of debt, we first look at cash and debt together.

Check out our latest analysis for Trinity Biotech

What Is Trinity Biotech’s Net Debt?

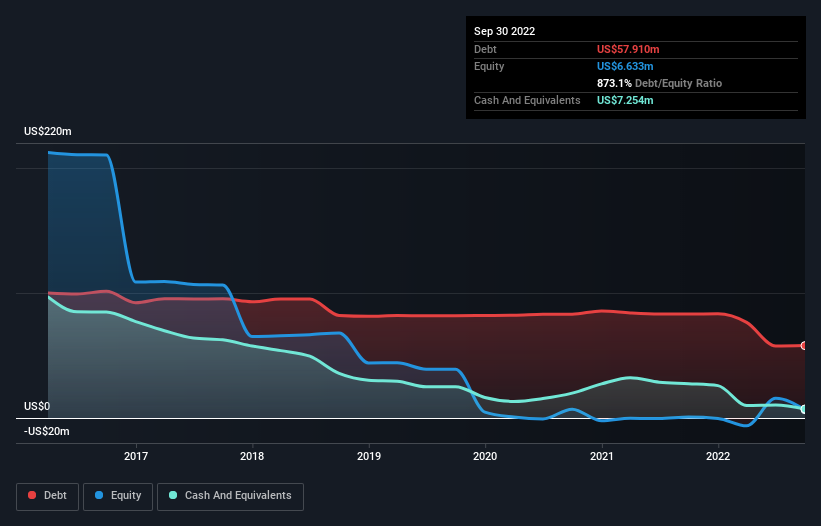

You can click the graphic below for the historical numbers, but it shows that Trinity Biotech had US$57.9m of debt in September 2022, down from US$83.2m, one year before. However, it also had US$7.25m in cash, and so its net debt is US$50.7m.

A Look At Trinity Biotech’s Liabilities

We can see from the most recent balance sheet that Trinity Biotech had liabilities of US$14.7m falling due within a year, and liabilities of US$76.5m due beyond that. Offsetting these obligations, it had cash of US$7.25m as well as receivables valued at US$19.0m due within 12 months. So its liabilities total US$65.0m more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$40.2m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Trinity Biotech would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Trinity Biotech can strengthen its balance sheet over time. So if you’re focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Trinity Biotech made a loss at the EBIT level, and saw its revenue drop to US$76m, which is a fall of 28%. To be frank that doesn’t bode well.

Caveat Emptor

While Trinity Biotech’s falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping US$8.4m. Considering that alongside the liabilities mentioned above make us nervous about the company. We’d want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through US$5.7m in negative free cash flow over the last year. That means it’s on the risky side of things. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet – far from it. We’ve identified 2 warning signs with Trinity Biotech (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

If, after all that, you’re more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

What are the risks and opportunities for Trinity Biotech?

Trinity Biotech plc acquires, develops, manufactures, and markets medical diagnostic products for the clinical laboratory and point-of-care (POC) segments of the diagnostic market in the Americas, Africa, Asia, and Europe.

View Full Analysis

Rewards

-

Trading at 87.7% below our estimate of its fair value

-

Earnings are forecast to grow 129.98% per year

Risks

-

Shareholders have been substantially diluted in the past year

-

Does not have a meaningful market cap ($40M)

View all Risks and Rewards

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

link